In the news last week, President Joe Biden said he wants to increase taxes to “help save Medicare.” Maine Democrats said they not only want to increases taxes, but to create an entirely new payroll tax to fund paid family leave. With both the state and federal budgets enjoying record levels of tax revenue and both having recently spent huge sums of money beyond that of previous budget years, this push to raise taxes reveals a fundamental misunderstanding of budgets among our elected officials and the media that report on them.

Here in Maine, Democrats increased the size of the state budget from $7.1 billion to $10 billion, a 30% jump in just one budget cycle. In Washington, tax revenues grew by more than 25% in 2021 alone. Despite this, lawmakers on both levels are publicly advocating for new or increased taxes as a way to fund still more government spending. In both cases, those crafting budgets should be, but are surprisingly not, aware that revenue increases are spurred by cutting tax rates, not increasing them.

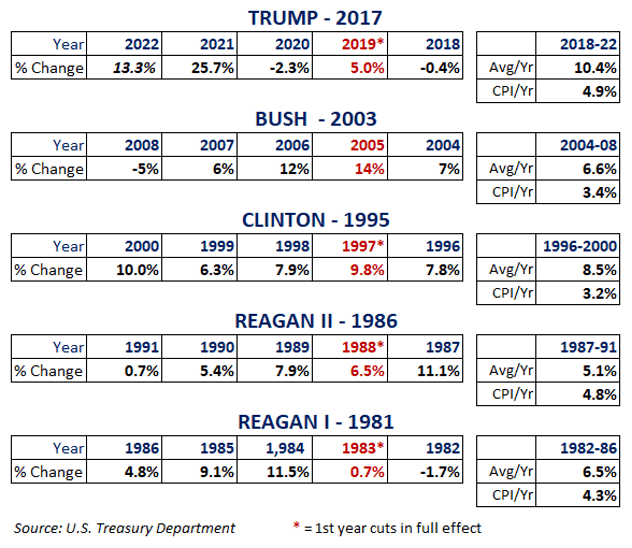

As the most recent example, the federal government has seen a massive increase in revenue since the 2017 so-called “Trump Tax Cuts” took effect. Passed in late 2017, these rate reductions were first in place for the 2018 tax year, and thus began to appear in revenue reports by the U.S. Treasury when Americans filed their tax returns in 2019.

Over the first four years, the Trump tax cuts led to an average annual revenue increase of 10.5%, a remarkable jump. Only the Clinton Tax Cuts from 1997-2000 came close to that growth with an average 8.5% annual increase. This is especially remarkable when one considers that 2020 saw a drop in revenue of 2.3% due to the onset of COVID. The following year, however, saw an incredible, never-before-seen leap of 25.7% in one year. Clearly, the tax cuts more than paid for themselves.

This windfall created what should be seen as an ideal situation. Congress left more money in taxpayers’ pockets, so they were happy. Republicans got their favored tax cuts, and Democrats had record amounts of money to spend of their favorite government programs. Instead, without bothering to look at past major tax cuts, Democrats and the media predicted doom and gloom.

Reuters: “The massive tax cuts signed into law in December, which Republicans said would pay for themselves, will balloon the U.S. deficit in years ahead, the Congressional Budget Office said.”

Washington Post: “The tax cut signed into law by Trump had an estimated revenue loss of a little under $1.5 trillion over 10 years.”

Forbes: “Less than a week after Treasury Secretary Mnuchin repeated the fanciful claim that the Trump tax cuts of 2017 would pay for themselves, the non-partisan Congressional Budget Office (CBO) proved him wrong.”

Senate majority Leader Charles Schumer: “The CBO’s latest report exposes the scam behind the rosy rhetoric from Republicans that their tax bill would pay for itself.”

Speaker Nancy Pelosi: “If Republicans have their way, they will blow a huge hole in the deficit, gut Medicare, Medicaid, Social Security and the Affordable Care Act – all just to fund deficit-busting tax breaks for the high-end.” Side note: If the deficit is bad, would not blowing a huge hole in it and busting it be beneficial?

Despite this evidence that they are wrong, national media are still decrying the “costs” of the tax cuts and the fact that neither party has the courage to repeal them. Less than a month ago, the Washington Post exhibited a remarkable inability to learn from the recent past when it argued that “Extending President Donald Trump’s individual tax cuts in full would add around $3 trillion to federal deficits over a decade.”

The article never explains how such a stark reversal in revenue trends would occur, probably because the author has no idea that the 2017 tax cuts led to such enormous gains in revenue. They are simply writing with the common belief that “tax cuts equal bad” without engaging in the simple exercise of actually checking the easily accessed revenue data.

Let’s be clear, large increases in revenue have never caused a deficit to increase. Blaming revenue growth for deficits is like saying, “I am much further in debt now because I got that big raise at work this year.” The Trump tax cuts delivered revenue gains of more than twice the rate of inflation for four years, including an unheard of 26% jump in one year alone, even in the face of a pandemic-driven economic downturn. To the extent that the deficit and debt rose after the tax cuts, the cause was increased spending, not revenue.

This is not opinion. It is simple mathematics. This is not an “analysis” of some set of fiscal reports. It is the record of actual deposits into the U.S. Treasury.

If those whose knee-jerk reaction to tax cuts is that they blow holes in budgets and increase deficits simply did some basic historical research they would find that the Trump tax cuts, though an unusually large example, were just the latest in a long line of major tax cut initiatives that have all had the same positive effect on federal revenue.

Under President George Bush, Congress passed a very unpopular set of cuts to tax rates, the largest of which became law in 2003. These led to an immediate, double-digit growth in revenue that, over the next four years, averaged 6.6%, nearly twice the rate of inflation. When recession hit in December 2007 with the bursting of the housing bubble, the Bush tax cuts left the federal treasury in much better shape than it would have been. By 2008, revenues were more than a quarter trillion dollars (28%) higher than they were just four years earlier. When President Obama took office, he reneged on his promise to repeal these tax cuts when advisors explained how effective they had been.

Following President Clinton’s tax cuts, federal revenue grew by more than 2.5 times the rate of inflation. President Reagan convinced Congress to cut tax rates twice during his term in office, both with revenue growth that exceeded inflation.

On a smaller scale, tax cuts have led to increased government revenue here in Maine as well. In 2011, the state legislature passed, and the governor signed, the largest tax cut in Maine history. Tens of thousands of low income Mainers had their tax liability eliminated completely, and everyone paid a lower rate. As they do with each federal tax cut proposal, critics of these cuts painted a doomsday scenario before the law passed and continued the same criticism even after it generated larger revenues. In the first two budget cycles under the new, lower tax rates, state government collected $135 million more than the budget required.

No amount of factual, statistical evidence, however, seems enough to convince naysayers that reducing tax rates is the best path toward raising more money for the big spenders in Augusta. Time and again they propose tax hikes as the way to raise revenue. Given the massive surpluses that the state has seen over the last few years, it is clear that Mainers are greatly overtaxed, and the circumstances are ripe for another round of revenue-boosting tax cuts. It is long past time we thought seriously about moving Maine out of its slot as the third highest-taxed state in the U.S.